How to Invest in The Timberline Fund

Please follow the instructions below to register for our investor portal, sign our Subscription Agreement document, and commit your funds.

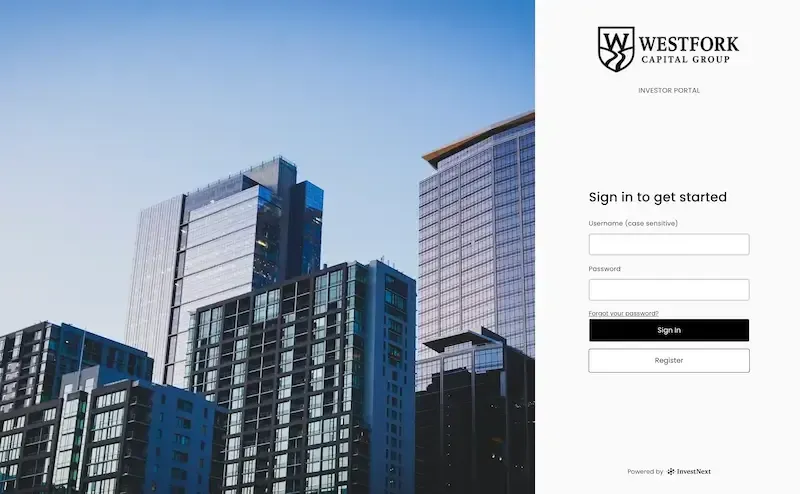

Step 1: Register for the Investor Portal

Click here to open the investor portal registration page.

From this page, click the "Register" button, then fill out the registration form. It will send you a verification email. Open the email to verify and set your password.

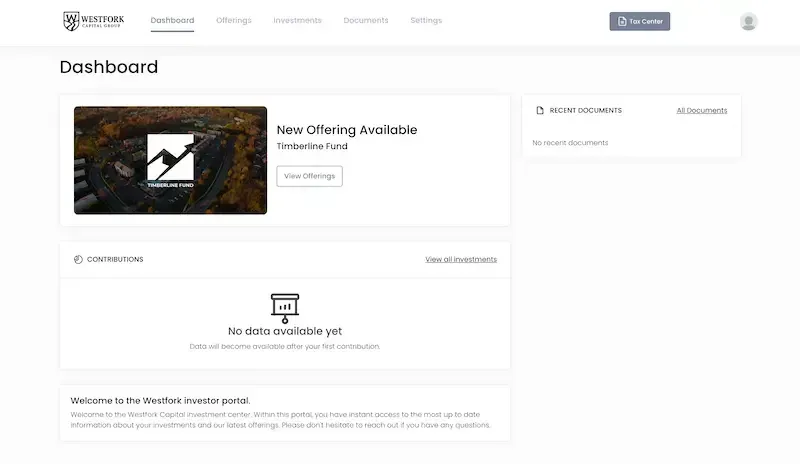

Step 2: Open the Offering Page

From the main dashboard, click "View Offerings" to open the Timberline Fund offering page.

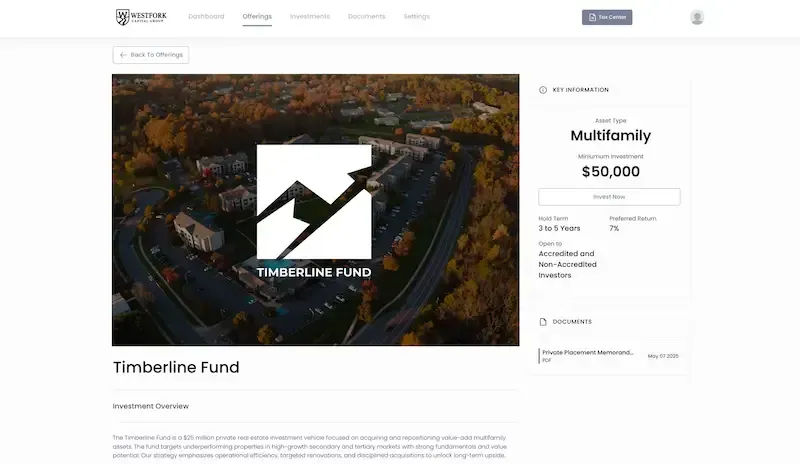

Step 3: Click "Invest Now"

On the Timberline Fund offering page, you can review general information about the fund. When you're ready to invest, click "Invest Now" on the right side of the page.

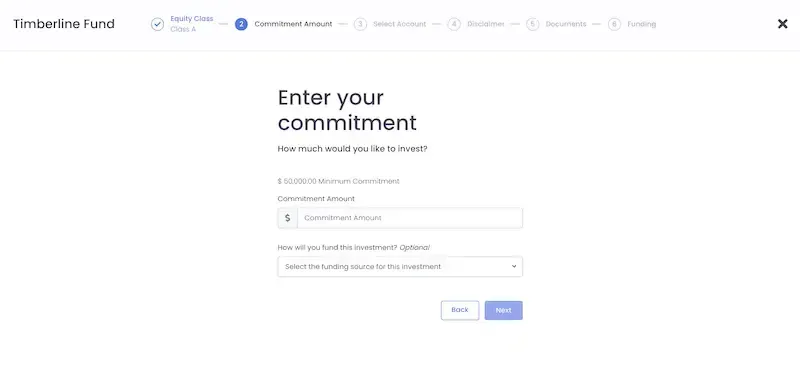

Step 4: Enter your Commitment Amount

You are now in the commitment flow for the Timberline Fund. The first step is entering your commitment amount.

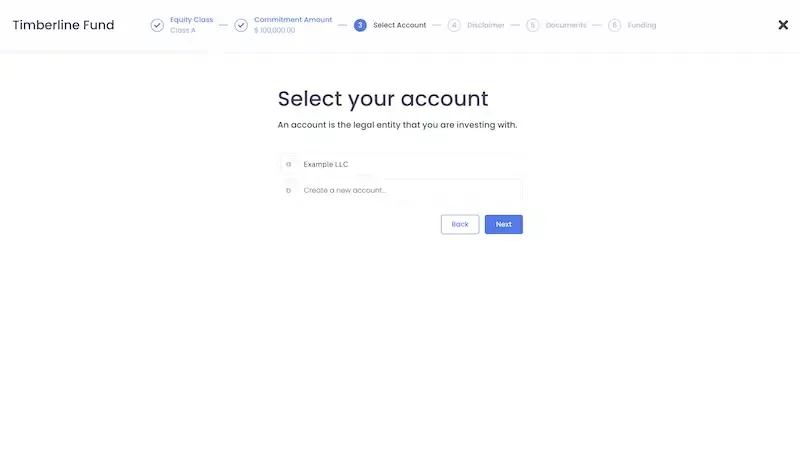

Step 5: Create your Account

Your "account" is the legal entity you will be investing with, whether you are investing as an individual, LLC, Trust or another entity. Start by clicking "create a new account". From there, you will enter information about your entity.

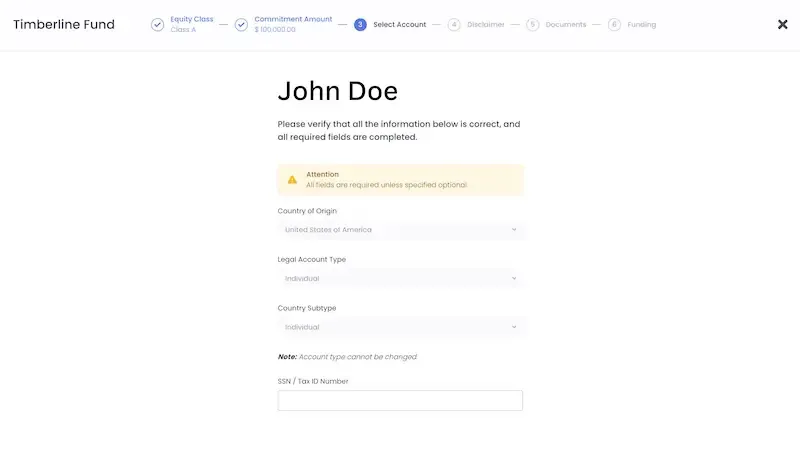

Step 6: Enter your Personal Information

On the next page, please enter and verify your personal information.

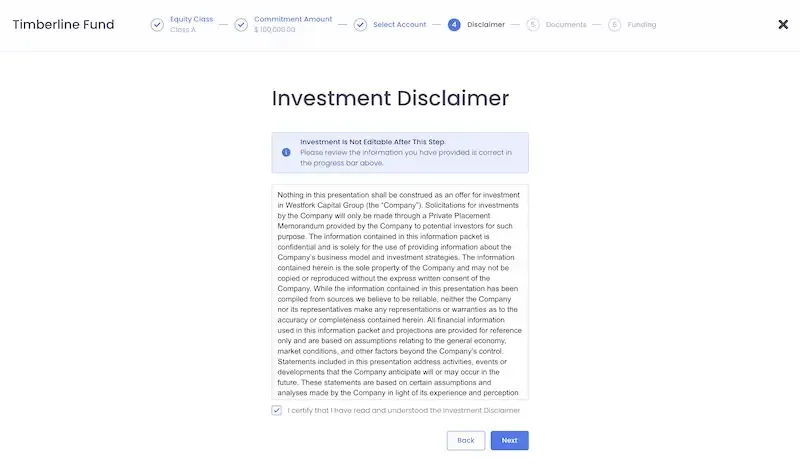

Step 7: Agree to the Investment Disclaimer

Please read and agree to the general disclaimer for the Timberline Fund.

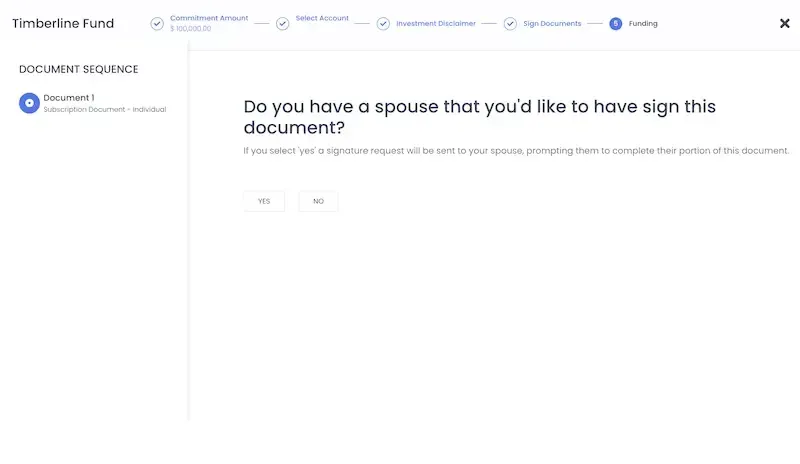

Step 8: Add a Spouse (if applicable)

If you have a spouse, please select "Yes" on this page. Our subscription agreement requires a signature if you have a spouse. It will email the document to your spouse so that they can sign the required field.

If you do not have a spouse, you can select "no" here and move on to the next step.

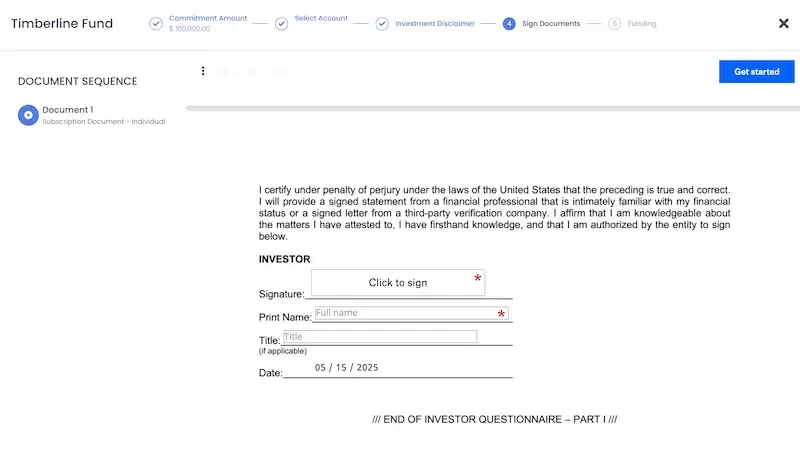

Step 9: Sign the Subscription Document

Click "Get Started" to start filling out the fields in the document. Please read through the document carefully to ensure that you fill it out completely and correctly.

Some fields are required for accredited investors, and some are required for non-accredited investors - please review these sections carefully as you fill out the document.

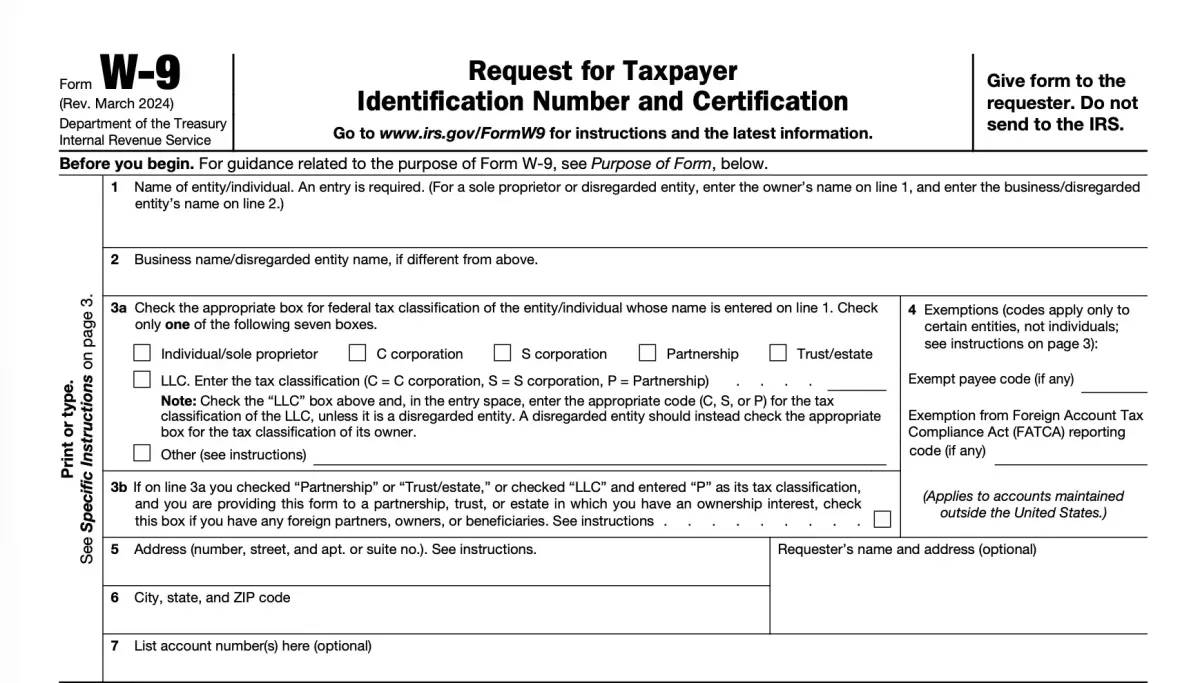

Step 10: Complete your W9 Form

Please complete and sign the IRS Form W-9 to provide your taxpayer identification information. This form is required for reporting purposes and ensures that any income or distributions from your investment can be properly documented for tax compliance.

Step 11: Transfer your Funds

The final step allows you to transfer your funds. We recommend using the ACH Payment option to transfer funds easily within the portal.

We've also included wire transfer instructions if you prefer to wire your funds to us.

Once your funds have been transferred & received, we will countersign your subscription document and your investment will be complete.

OUR TEAM

Our team brings decades of experience in real estate investment, operations, and asset management.

David Rosenbaum

Member

Chad Selman

Member

Dalton Buehler

Member

Colt Buehler

Member

Jonah Wright

Member

Frequently Asked Questions

What is the Timberline Fund?

The Timberline Fund is a $25 million private real estate investment vehicle strategically focused on acquiring and repositioning value-add multifamily assets in high-growth secondary markets across the United States. By targeting well-located but underperforming properties with strong upside potential, the Fund aims to unlock hidden value through targeted capital improvements, operational efficiencies, and proactive asset management. This approach is designed to deliver attractive risk-adjusted returns, stable cash flow, and long-term capital appreciation for investors, while contributing to the revitalization of communities in rapidly expanding urban and suburban corridors.

What is the investment strategy?

The fund targets value-add multifamily properties in dynamic secondary markets characterized by robust economic fundamentals, sustained population growth, and strong, unmet rental demand. These markets often offer attractive entry points, lower competition, and greater potential for outsized returns compared to primary metros. By capitalizing on favorable demographic shifts, job creation, and housing supply imbalances, the fund is well-positioned to generate compelling risk-adjusted returns while creating high-quality living environments that meet the evolving needs of today’s renters.

What types of properties does the fund invest in?

The fund targets value-add multifamily properties in dynamic secondary markets characterized by robust economic fundamentals, sustained population growth, and strong, unmet rental demand. These markets often offer attractive entry points, lower competition, and greater potential for outsized returns compared to primary metros. By capitalizing on favorable demographic shifts, job creation, and housing supply imbalances, the fund is well-positioned to generate compelling risk-adjusted returns while creating high-quality living environments that meet the evolving needs of today’s renters.

What is the expected return for investors?

Investors are offered a 7% annual preferred return, distributed prior to any profit-sharing with the sponsor, ensuring that investor capital is prioritized. The fund is targeting a 1.5x equity multiple over a projected 3–5 year hold period, reflecting a disciplined approach to value creation and capital preservation. This return profile is supported by a focus on well-underwritten, cash-flowing assets with clear upside potential through renovation, re-tenanting, and operational improvements in select high-growth secondary markets.

How are returns generated?

Investor returns are generated through a dual-source strategy: consistent, stabilized cash flow during the hold period and significant value creation realized at exit. This is achieved by enhancing property operations, optimizing tenant mix, implementing strategic capital improvements, and capitalizing on market appreciation. By increasing net operating income and asset quality, the fund positions each property for a premium disposition, ultimately maximizing total investor returns.

How is investor capital protected?

Capital is strategically diversified across a portfolio of multiple multifamily assets to mitigate risk and enhance overall portfolio stability. The fund employs a disciplined

investment approach rooted in conservative underwriting, stress-tested financial modeling, and rigorous due diligence. This is complemented by active, hands-on asset management to drive operational performance, safeguard investor capital, and maximize long-term value creation.

Who manages the fund?

The fund is professionally asset-managed by Westfork Capital Group, a seasoned real estate investment firm with a proven track record in sourcing, acquiring, and repositioning multifamily assets. Leveraging deep expertise across acquisitions, operational optimization, and market analytics, Westfork brings an institutional-level approach to investment execution and portfolio management, ensuring disciplined oversight and alignment with investor objectives.

What makes Westfork Capital Group qualified to manage the fund?

Westfork Capital Group brings a demonstrated track record of success in multifamily real estate, combining a data driven investment strategy with active, hands-on asset management to drive operational performance and mitigate downside risk. By leveraging advanced market analytics, disciplined underwriting, and on-the-ground execution, Westfork is committed to delivering consistent, risk-adjusted returns while preserving and enhancing investor capital.

Who can invest?

Participation in the Timberline Fund is limited to individuals and entities who qualify as either Accredited Investors under Rule 501 of Regulation D of the Securities Act of 1933, or as Sophisticated Investors. A Sophisticated Investor is defined as someone who, either alone or with the assistance of a purchaser representative, possesses sufficient knowledge and experience in financial and business matters to be capable of evaluating the merits and risks of a prospective investment. Investor eligibility will be determined through a required Investor Questionnaire, which must be completed and approved prior to any commitment of capital. This process ensures compliance with applicable securities regulations and helps confirm that the investment aligns with the investor’s financial objectives and risk tolerance.

What is the minimum investment amount?

The Timberline Fund requires a minimum investment commitment of $50,000, providing investors with access to a diversified portfolio of institutional-quality multifamily real estate opportunities.

How do I get updates on my investment?

Investors can conveniently track performance and access real-time updates, reports, and key documents through our secure online investment portal.

How do I get started?

You can get started by clicking here, then registering through our investor portal.

Get In Touch

© Westfork Capital Group 2025